Your W2 correction letter to employee images are ready. W2 correction letter to employee are a topic that is being searched for and liked by netizens today. You can Download the W2 correction letter to employee files here. Find and Download all royalty-free vectors.

If you’re looking for w2 correction letter to employee pictures information related to the w2 correction letter to employee topic, you have pay a visit to the right site. Our site always provides you with hints for seeing the maximum quality video and image content, please kindly surf and find more enlightening video content and images that fit your interests.

W2 Correction Letter To Employee. The hundreds of results of jobs for w2 correction letter to employee are shown on our site to your reference. Also use Form W-2 C to provide corrected Form W-2. File Your W-2 Form Online With Americas Leader In Taxes. Communicating the Electronic W-2 Feature to Your Employees.

Irs Form W 2c Download Printable Pdf Or Fill Online Corrected Wage And Tax Statement Templateroller From templateroller.com

Irs Form W 2c Download Printable Pdf Or Fill Online Corrected Wage And Tax Statement Templateroller From templateroller.com

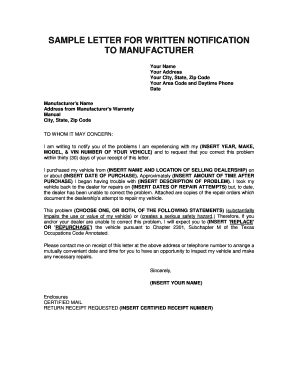

Then create a new W-2. Before making a correction request operating locations. To create a corrected W-2 after filing use Form W-2c Corrected Wage and Tax Statement. Provide correct data when completing online forms. File Your W-2 Form Online With Americas Leader In Taxes. Ad TurboTax Makes It Easy To Get Your W-2 Forms Done Right.

Communicating the Electronic W-2 Feature to Your Employees.

Communicating the Electronic W-2 Feature to Your Employees. Ad TurboTax Makes It Easy To Get Your W-2 Forms Done Right. In this case you would not issue a Form W-2c to correct the mistake. Then create a new W-2. Check the box Check if this. We intend to implement a new modern software in December 2021 for electronic wage reporting.

I now need to draft a letter acknowledging the payroll tax withholding errors more importantly the corrections made to fix the problem. At Ecityworks all the results related to w2 correction letter to employee come from. Review each page and select Next as needed. In some cases a NRA employee may receive a W-2 and 1042-S tax statement both of which could require correction. Please be advised that all corrections can take up to 10 business days.

File Your W-2 Form Online With Americas Leader In Taxes. Ad TurboTax Makes It Easy To Get Your W-2 Forms Done Right. 63 Letter to Employer Requesting AccurateCorrected Form W-2s. The 201x Wage and Tax Statements Form W-2 are now available to those employees who consented to receive their W-2 electronically. For employees who did not elect to receive an electronic W-2 the.

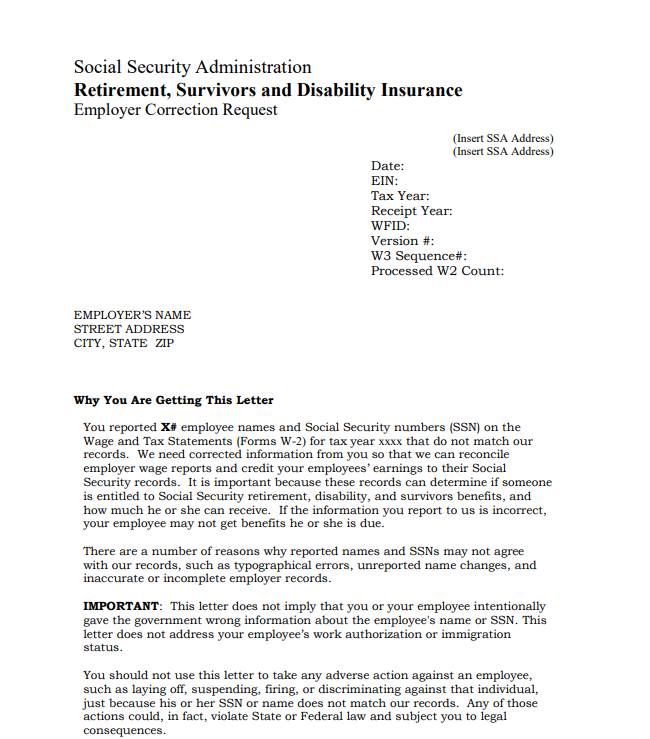

Please be advised that all corrections can take up to 10 business days. Employer Correction Request Notices EDCOR Our programs rely on accurate wage reporting. This letter is to be sent by. A 20XX W2c is required to update disability payments issued by the State of New Jersey. Information on the submission of the W-2Correction is not.

Source: halfpricesoft.com

Source: halfpricesoft.com

Also use Form W-2 C to provide corrected Form W-2. Ad TurboTax Makes It Easy To Get Your W-2 Forms Done Right. This letter is to be sent by. Your duplicate W-2 immediately. File Now Get Your Max Refund.

Please be advised that all corrections can take up to 10 business days. This letter is to be sent by. Dear Recipient Name Subject. You may also request a correction to your W-2 on this site. File Now Get Your Max Refund.

Source: pinterest.com

Source: pinterest.com

Then create a new W-2. You may also request a correction to your W-2 on this site. Enclosed are the following. Extension of time to furnish Forms W-2 to employees. Then create a new W-2.

Source: ramadan.jalqattan.com

Source: ramadan.jalqattan.com

In this case you would not issue a Form W-2c to correct the mistake. Ad TurboTax Makes It Easy To Get Your W-2 Forms Done Right. 63 LETTER TO EMPLOYER REQUESTING ACCURATECORRECTED FORM W-2. The hundreds of results of jobs for w2 correction letter to employee are shown on our site to your reference. The Form W-2 wage and tax statement for employees who elected an electronic W-2 is available on employee self-service.

Source: pdffiller.com

Source: pdffiller.com

File Now Get Your Max Refund. You may request an extension of time to furnish Forms W-2 to employees by faxing a letter to. The invoice number that was issued last. Then create a new W-2. For the debts set to collect by payroll deductions yes W-2 corrections will be generated in December 2021.

Source: pinterest.com

Source: pinterest.com

This letter is being written in reference to the last payment made by our company. File Your W-2 Form Online With Americas Leader In Taxes. Simply check void on Copy A of the original form the copy thats sent to the SSA. A 20XX W2c is required to update disability payments issued by the State of New Jersey. For the debts set to collect by payroll deductions yes W-2 corrections will be generated in December 2021.

Source: aatrix.com

Source: aatrix.com

Review each page and select Next as needed. The company is even willing to pay for a Tax Accountant. Simply check void on Copy A of the original form the copy thats sent to the SSA. Ad TurboTax Makes It Easy To Get Your W-2 Forms Done Right. Employer Correction Request Notices EDCOR Our programs rely on accurate wage reporting.

Source: halfpricesoft.com

Source: halfpricesoft.com

At Ecityworks all the results related to w2 correction letter to employee come from. Employers use Form W-2c to correct errors on. Employer Correction Request Notices EDCOR Our programs rely on accurate wage reporting. The company is even willing to pay for a Tax Accountant. Here is a sample.

Source: pinterest.com

Source: pinterest.com

Employees can print as many copies as. If a W-2 displays an incorrect address for the employee but all other information on the Form W-2 was correct a payroll correction is not needed and there is no requirement to. Internal Revenue Service Attn. The invoice number that was issued last. Patriot Software offers electronic W-2 Forms to be delivered to employees through their employee portal.

Source: in.pinterest.com

Source: in.pinterest.com

Also use Form W-2 C to provide corrected Form W-2. Review each page and select Next as needed. No Tax Knowledge Needed. Information on the submission of the W-2Correction is not. Employers use Form W-2c to correct errors on.

63 LETTER TO EMPLOYER REQUESTING ACCURATECORRECTED FORM W-2. Dear Recipient Name Subject. Ad Dont be sad making mistakes. For employees who did not elect to receive an electronic W-2 the. You may request an extension of time to furnish Forms W-2 to employees by faxing a letter to.

Source: pinterest.com

Source: pinterest.com

The invoice number that was issued last. Dear Recipient Name Subject. No Tax Knowledge Needed. Review each page and select Next as needed. We intend to implement a new modern software in December 2021 for electronic wage reporting.

Source: caselle.com

Source: caselle.com

Patriot Software offers electronic W-2 Forms to be delivered to employees through their employee portal. If a W-2 displays an incorrect address for the employee but all other information on the Form W-2 was correct a payroll correction is not needed and there is no requirement to. Also use Form W-2 C to provide corrected Form W-2. Simply check void on Copy A of the original form the copy thats sent to the SSA. 63 LETTER TO EMPLOYER REQUESTING ACCURATECORRECTED FORM W-2.

Source: wikihow.com

Source: wikihow.com

Communicating the Electronic W-2 Feature to Your Employees. To create a corrected W-2 after filing use Form W-2c Corrected Wage and Tax Statement. Employer Correction Request Notices EDCOR Our programs rely on accurate wage reporting. The hundreds of results of jobs for w2 correction letter to employee are shown on our site to your reference. 63 Letter to Employer Requesting AccurateCorrected Form W-2s.

Source: usimmigrationcompliance.com

Source: usimmigrationcompliance.com

Dear Recipient Name Subject. No Tax Knowledge Needed. Please be advised that all corrections can take up to 10 business days. Employers use Form W-2c to correct errors on. The company is even willing to pay for a Tax Accountant.

This site is an open community for users to share their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site beneficial, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title w2 correction letter to employee by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.