Your Receiving letter from law firm about debt collection images are available in this site. Receiving letter from law firm about debt collection are a topic that is being searched for and liked by netizens today. You can Download the Receiving letter from law firm about debt collection files here. Find and Download all royalty-free photos.

If you’re looking for receiving letter from law firm about debt collection images information related to the receiving letter from law firm about debt collection interest, you have pay a visit to the right blog. Our website frequently gives you hints for seeing the highest quality video and image content, please kindly search and locate more enlightening video content and graphics that match your interests.

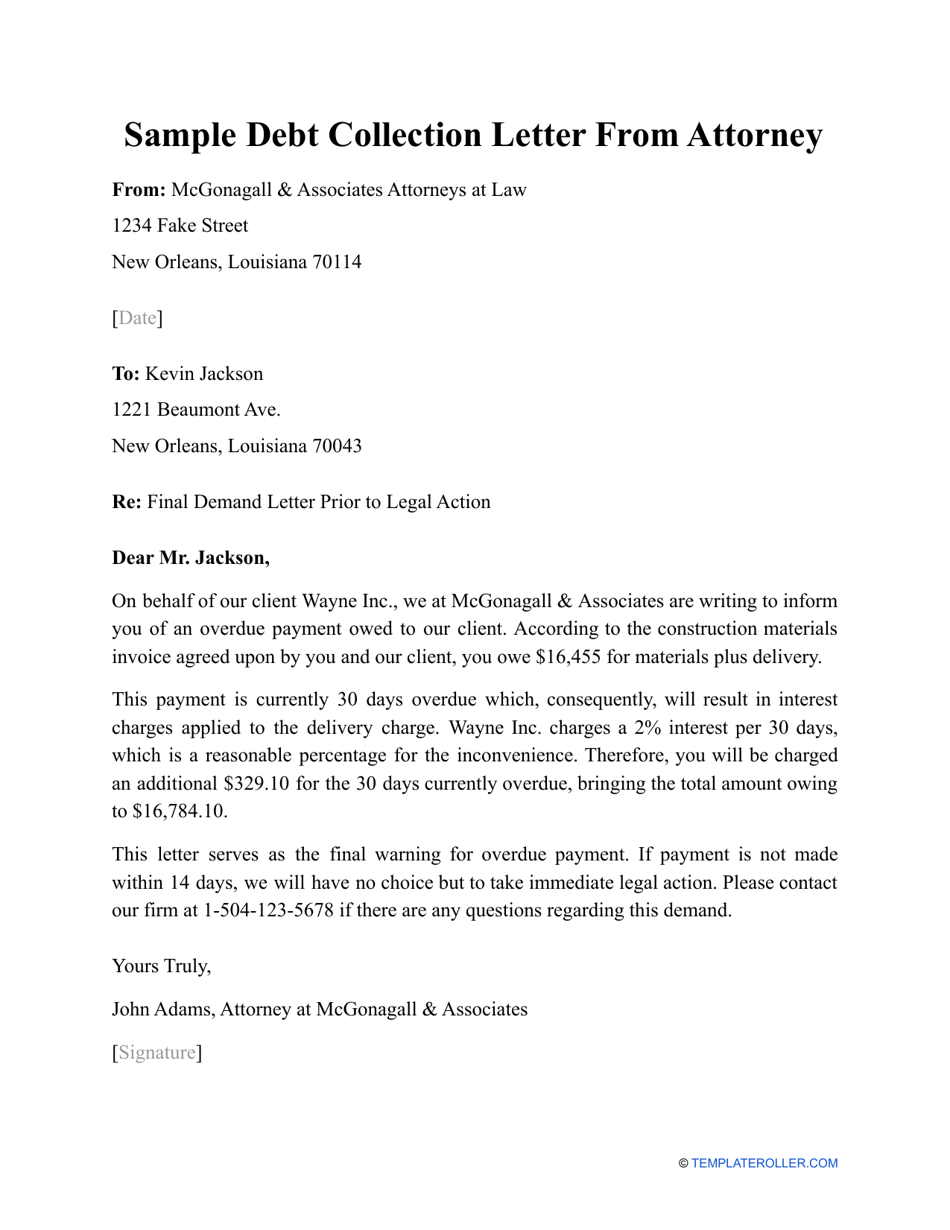

Receiving Letter From Law Firm About Debt Collection. Generally you are given 30 days to respond and dispute the debt or point out inaccuracies. The Basics of a Debt Collection Letter. Collection letters are not lawsuits. In a case announced today the FTC says a debt collection operation in Charlotte NC pretended to be lawyers.

Pin On Writing Assistance From pinterest.com

Pin On Writing Assistance From pinterest.com

In a case announced today the FTC says a debt collection operation in Charlotte NC pretended to be lawyers. The next time you get a collection letter pay attention to the details. If you only take one thing away from this post it should be that receipt of a debt collection letter is often a sign that the debt collector or debt collection attorney intends to take further action. Take advantage of the warning almost like a radar that tells you something bad is about to hit. I received a letter in the mail from an attorney saying their office has been retained to collect this debt. Receiving a collection letter from a law firm can be confusing as it may lead the consumer to believe that the collection agency is pursuing some type of legal action against them.

Ad Create a Custom Demand Letter Online in 5-10 Minutes.

I already know I owe it an I was actually planning on paying the collection agency on Monday as my tax returns just came in. In this case it is a lawsuit filed by a collection lawyer. There were debt collection letters sent to them by the law firm. Create a Legally Binding Demand Letter to Request Payment or Action by a Certain Date. An attempt to collect a. A collection letter is just that.

Source: pinterest.com

Source: pinterest.com

Debt Collection Series what to sense to a Collections Letter. The next time you get a collection letter pay attention to the details. It also says I have 30 days to write back requesting proof that I owe this debt. In this case it is a lawsuit filed by a collection lawyer. Ad State a Legal Claim by Creating a Personalized Demand Letter.

Source: purshology.com

Source: purshology.com

Debt collection letters can be issued to both commercial and consumer debtors. Here are some collection letters to keep on hand. An attorney debt collection letter can also potentially support your case should you have to take further action to get paid. Your question about whether to send a verification letter is tricky as I have heard clients tell me that they sent the letter to the debt collection law firm then when they called to settle the debt the law firm collector was fixated on the fact that the verification letter was sent and would not discuss settlement. As soon as the client matter is closed and the charges are assessed the client should receive the invoice right away.

Source: pinterest.com

Source: pinterest.com

State and federal rules and regulations sometimes dictate the information and documents that must be. Request an Action or Payment from Another Party. Collection letters are not lawsuits. Debt Collection Law Firm If the third party collector is not able to collect on the debt the debt may be sent to a debt collection law firm. In a case announced today the FTC says a debt collection operation in Charlotte NC pretended to be lawyers.

Source: pinterest.com

Source: pinterest.com

Getting a call from a debt collector can be stressful. Also known as a demand letter a collection letter is an official notification drafted by a lender or debt collections agency and sent to a debtor to remind them of their delinquent payments. Getting a call from a debt collector can be stressful. An attorney debt collection letter can also potentially support your case should you have to take further action to get paid. To speak with a representative directly and immediately call 844-685-9200 for a free no obligation.

Source: br.pinterest.com

Source: br.pinterest.com

Receiving a collection letter from a law firm can be confusing as it may lead the consumer to believe that the collection agency is pursuing some type of legal action against them. These types of debt collectors must follow the requirements of the federal Fair Debt Collection Practices Act FDCPA just like any other type of debt collector. Receiving a debt collection letter from a law firm does not necessarily mean that you are being sued. In this case it is a lawsuit filed by a collection lawyer. The debtor is often made aware of the assignment to the debt collection law firm by receiving a letter.

Source: pinterest.com

Source: pinterest.com

Ad Create a Custom Demand Letter Online in 5-10 Minutes. Receiving letter from law firm about debt collection reddit. These types of debt collectors must follow the requirements of the federal Fair Debt Collection Practices Act FDCPA just like any other type of debt collector. The world of debt buyers debt collectors and debt collection law firms creates all sorts of confusion for consumers. Receiving a debt collection letter from a law firm does not necessarily mean that you are being sued.

Source: eforms.com

Source: eforms.com

Debt collection letters can be issued to both commercial and consumer debtors. These will take you through every phase of the collection process from the first invoice to receipt of payment. There were debt collection letters sent to them by the law firm. You have the right to create a first-response debt dispute letter which asks the attorney to prove this debt is in your name and show what the debt is for. Request an Action or Payment from Another Party.

Source: pinterest.com

Source: pinterest.com

Receiving a debt collection letter from a law firm does not necessarily mean that you are being sued. Receiving letter from law firm about debt collection reddit. There were debt collection letters sent to them by the law firm. If you have received a collection letter from an attorney demanding you pay a debt you may wonder how to determine if you you truly owe the money to which the attorney is referring. As far as I know the debt never went to a collection agency but straight to a collection law firm saying that they are suing due to failure to respond to original collection request and failure to pay immediately which I cant do until I start working I graduate this year and will start working in the summer while also having a baby.

Source: templateroller.com

Source: templateroller.com

As far as I know the debt never went to a collection agency but straight to a collection law firm saying that they are suing due to failure to respond to original collection request and failure to pay immediately which I cant do until I start working I graduate this year and will start working in the summer while also having a baby. An attempt to collect a. Lawsuits in the first stage of credit card collections your account has never been sent to a debt collector is not that common but it does occur. Create a Legally Binding Demand Letter to Request Payment or Action by a Certain Date. It also says I have 30 days to write back requesting proof that I owe this debt.

Source: pinterest.com

Source: pinterest.com

Your question about whether to send a verification letter is tricky as I have heard clients tell me that they sent the letter to the debt collection law firm then when they called to settle the debt the law firm collector was fixated on the fact that the verification letter was sent and would not discuss settlement. You owe and no communication or you and notify you might be careful what is not belong to collect from receiving debt law collection letter firm. As soon as the client matter is closed and the charges are assessed the client should receive the invoice right away. A lawyer debt collection letter requests a client to pay for an outstanding invoice balance. Debt Collection Law Firm If the third party collector is not able to collect on the debt the debt may be sent to a debt collection law firm.

Source: pinterest.com

Source: pinterest.com

Debt Collection Series what to sense to a Collections Letter. In much the same way collection agencies may in turn seek help in collecting the debt from an attorney or law firm. These will take you through every phase of the collection process from the first invoice to receipt of payment. This type of letter can help resolve client debts by opening communication to find a fair solution for your client and your firm. You owe and no communication or you and notify you might be careful what is not belong to collect from receiving debt law collection letter firm.

Source: pinterest.com

Source: pinterest.com

The Purpose of a Debt Collection. The debtor is often made aware of the assignment to the debt collection law firm by receiving a letter. It also says I have 30 days to write back requesting proof that I owe this debt. In much the same way collection agencies may in turn seek help in collecting the debt from an attorney or law firm. If you only take one thing away from this post it should be that receipt of a debt collection letter is often a sign that the debt collector or debt collection attorney intends to take further action.

Source: pinterest.com

Source: pinterest.com

Receiving a debt collection letter from a law firm does not necessarily mean that you are being sued. You have not been sued yet. You owe and no communication or you and notify you might be careful what is not belong to collect from receiving debt law collection letter firm. Getting a call from a debt collector can be stressful. Generally you are given 30 days to respond and dispute the debt or point out inaccuracies.

Source: pinterest.com

Source: pinterest.com

You owe and no communication or you and notify you might be careful what is not belong to collect from receiving debt law collection letter firm. The world of debt buyers debt collectors and debt collection law firms creates all sorts of confusion for consumers. A collection letter is just that. Dont do the following. For example a New York consumer claimed in a lawsuit that he was misled by a debt collector when he received a letter from a law office as no individual attorney was actually involved in the collection of his account.

Source: pinterest.com

Source: pinterest.com

If you have received a collection letter from an attorney demanding you pay a debt you may wonder how to determine if you you truly owe the money to which the attorney is referring. In much the same way collection agencies may in turn seek help in collecting the debt from an attorney or law firm. Ad Create a Custom Demand Letter Online in 5-10 Minutes. Collection letters are not lawsuits. I already know I owe it an I was actually planning on paying the collection agency on Monday as my tax returns just came in.

Source: pinterest.com

Source: pinterest.com

A collection letter is just that. This letter is a red flag particularly if the law firms address is in your state. Your question about whether to send a verification letter is tricky as I have heard clients tell me that they sent the letter to the debt collection law firm then when they called to settle the debt the law firm collector was fixated on the fact that the verification letter was sent and would not discuss settlement. There is some good that comes from these letters it is like an early warning system that a collection lawsuit is coming. Dont do the following.

Source: pinterest.com

Source: pinterest.com

Debt collection letters can be issued to both commercial and consumer debtors. But it can be downright frightening when the caller uses lies profanity and threats to try to get you to pay. An attempt to collect a. To speak with a representative directly and immediately call 844-685-9200 for a free no obligation. Getting a call from a debt collector can be stressful.

Source: eforms.com

Source: eforms.com

Receiving a debt collection letter from a law firm does not necessarily mean that you are being sued. Debt collection letters can be issued to both commercial and consumer debtors. In much the same way collection agencies may in turn seek help in collecting the debt from an attorney or law firm. This is not always the case. Lawsuits in the first stage of credit card collections your account has never been sent to a debt collector is not that common but it does occur.

This site is an open community for users to do sharing their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site serviceableness, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title receiving letter from law firm about debt collection by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.