Your Estate closing letter to beneficiaries images are available in this site. Estate closing letter to beneficiaries are a topic that is being searched for and liked by netizens today. You can Download the Estate closing letter to beneficiaries files here. Get all free photos.

If you’re searching for estate closing letter to beneficiaries images information related to the estate closing letter to beneficiaries topic, you have come to the ideal site. Our website frequently gives you hints for refferencing the maximum quality video and image content, please kindly search and find more informative video content and graphics that fit your interests.

Estate Closing Letter To Beneficiaries. Ideally no distributions to the beneficiaries under the will should be make until the estate is closed and closing letters received from the Internal Revenue Service and the State Tax Commission if estate tax returns were filed. Trustees have a legal duty to keep the beneficiaries of a trust informed about how the trust assets are being managed. How do you write a beneficiary letter. For example many people leave charitable organizations as beneficiaries in their will.

Change Of Beneficiary Form Letter With Sample Reference Letter Writing A Reference Letter Letter Templates From pinterest.com

Change Of Beneficiary Form Letter With Sample Reference Letter Writing A Reference Letter Letter Templates From pinterest.com

The Notice of Hearing must include the following statement in not less than 10-point boldface type in substantially the following words. See Step 348 above and forms below. Dont forget you need to include organizations who are beneficiaries. Make the final distribution from the deceased estate to each Beneficiary. FILL IN NAME OF TESTATORDECEASED named me executor in hisher will. E an independent executors closing report or notice of closing estate shall constitute sufficient legal authority to all persons owing any money having custody of any property or acting as registrar or transfer agent or trustee of any evidence of interest indebtedness property or right that belongs to the estate for payment or transfer.

Format for Letter From Executor to Beneficiaries A1122 Park Avenue Street New York 05 April 2005 Mark Jacob 52 Richmond Street New York Dear Sir Re.

Accordingly please find enclosed a check made payable. Based on current restrictions due to the declared National Emergency we will only accept a request for an estate tax closing letter by facsimile to 855-386-5127 or 855-386-5128. FILL IN NAME OF TESTATORDECEASED named me executor in hisher will. However keep in mind that most estates are not large enough to owe estate taxes. How do you write a beneficiary letter. Save the letter to heirs of estate sample print or email it.

Source: qldestatelawyers.com.au

Source: qldestatelawyers.com.au

Distribute remaining assets to beneficiaries. Either before or simultaneously with sending the Estate Distribution Letter the executor or personal representative may be required to file an accounting with the probate court or provide an accounting to the heirs and beneficiaries or others with an. Steps in Closing an Estate of a Decendent with Beneficiaries 1Notify all creditors2File tax returns and pay final taxes3File the final accounting with the probate court4Distribute remaining assets to beneficiaries5File a closing statement with the court. See Step 349 above. Estate Distribution Letter To Beneficiaries.

Source: simplyestate.com.au

Source: simplyestate.com.au

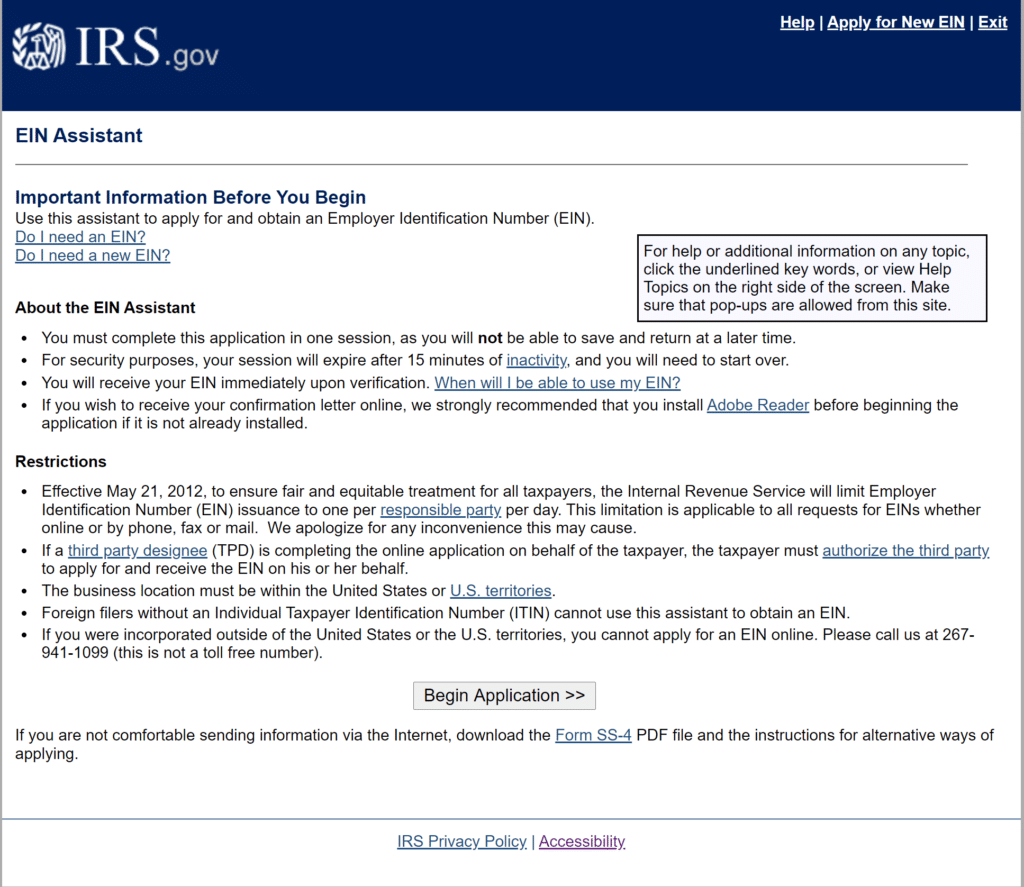

An estate tax closing letter is a form letter that the Internal Revenue Service IRS will send to you after your IRS Form 706 has been reviewed and accepted. An estate can be closed in one of four fashions. If an estate tax return was filed you may wish to request an Estate Tax Closing Letter before making final distributions. Based on current restrictions due to the declared National Emergency we will only accept a request for an estate tax closing letter by facsimile to 855-386-5127 or 855-386-5128. For example many people leave charitable organizations as beneficiaries in their will.

Source: dummies.com

Source: dummies.com

Select the document you want to sign and click Upload. Its the trustees responsibility to keep beneficiaries informed about whats going on with the trust. For example many people leave charitable organizations as beneficiaries in their will. Form DE-120 Judicial Council must be sent to persons interested in the estate at least 15 days prior to the hearing. Steps in Closing an Estate of a Decendent with Beneficiaries 1Notify all creditors2File tax returns and pay final taxes3File the final accounting with the probate court4Distribute remaining assets to beneficiaries5File a closing statement with the court.

Source: signnow.com

Source: signnow.com

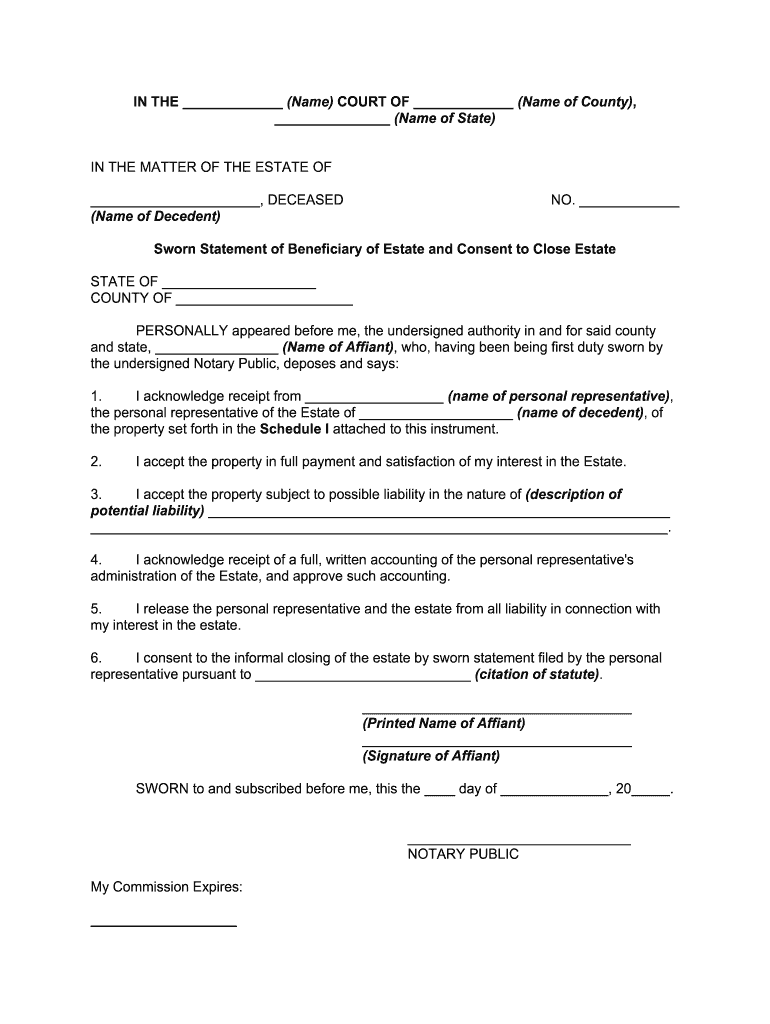

The signing of the assent form indicates that the beneficiaries approve of the documents and the release of the executor. DH and I are happy to take on the bulk of the work to obtain the Grant of Probate and then to pay out the inheritances to the beneficiaries - DH is the residuary beneficiary. Hello I am pleased to announce that the probate process has finally concluded and the will of is now ready for execution. To effectively close the estate each beneficiary must sign and return the assent forms. 2 the funds can be distributed to heirs after each signs a Release and Refunding Bond waiving his or her right to a formal accounting.

Fill out the form and add an eSignature. Decide on what kind of eSignature to create. Close the estate bank accounts and any other services used. In practice the primary purpose and benefit of receiving the Estate Closing Letter is that it gives the estates executor clearance to wrap up and close the estate including the distribution of any remaining property that may have been held back as a contingency in case anymore Federal estate taxes were assessed against the estate. Based on current restrictions due to the declared National Emergency we will only accept a request for an estate tax closing letter by facsimile to 855-386-5127 or 855-386-5128.

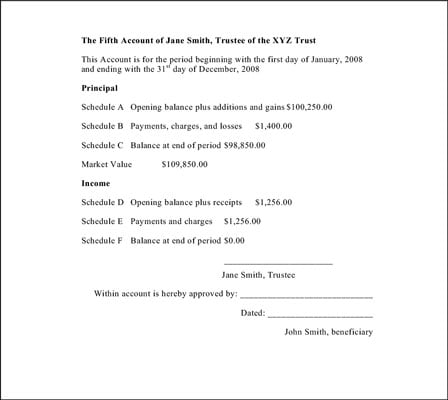

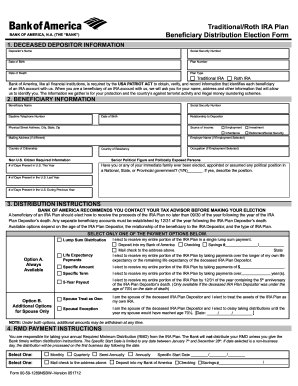

Estate Closing Letter To Beneficiaries signNow Electronic Signature Templates Sworn statement of beneficiary of estate and consent to close estate form How it works Select the sample letter from executor to beneficiary and open it. Letter from executor to beneficiaries enclosing your request. Estate tax closing letters will only be issued upon request by the taxpayer or taxpayers representative. The Notice of Hearing must include the following statement in not less than 10-point boldface type in substantially the following words. This steps objective is to discuss with the Beneficiaries the estate subject to final changes their likely inheritance value and inheritance distribution.

Source: pinterest.com

Source: pinterest.com

DH and I are happy to take on the bulk of the work to obtain the Grant of Probate and then to pay out the inheritances to the beneficiaries - DH is the residuary beneficiary. If the trustee is not required to send a particular document to the beneficiaries based on state law or the trust agreement the item may be omitted. Form 706 is also used to. Its the trustees responsibility to keep beneficiaries informed about whats going on with the trust. FILL IN NAME OF TESTATORDECEASED named me executor in hisher will.

Source: wiki.heritagetrustcompany.ca

Source: wiki.heritagetrustcompany.ca

Estate Closing Letter To Beneficiaries signNow Electronic Signature Templates Sworn statement of beneficiary of estate and consent to close estate form How it works Select the sample letter from executor to beneficiary and open it. Distribute remaining assets to beneficiaries. 3 distribution can be made after the beneficiaries each execute a Refunding Bond and Release. An estate tax closing letter is a form letter that the Internal Revenue Service IRS will send to you after your IRS Form 706 has been reviewed and accepted. Form 706 is a rather lengthy return that the executor of an estate will file after the death of an individual.

Source: wiki.heritagetrustcompany.ca

Source: wiki.heritagetrustcompany.ca

If you are settling an estate you may also need to send an Estate Distribution Letter form. Close the estate bank accounts and any other services used. Ideally no distributions to the beneficiaries under the will should be make until the estate is closed and closing letters received from the Internal Revenue Service and the State Tax Commission if estate tax returns were filed. Estate Closing Letter To Beneficiaries signNow Electronic Signature Templates Sworn statement of beneficiary of estate and consent to close estate form How it works Select the sample letter from executor to beneficiary and open it. FILL IN NAME OF TESTATORDECEASED named me executor in hisher will.

Source: aaronhall.com

Source: aaronhall.com

Letter from executor to beneficiaries enclosing your request. Steps in Closing an Estate of a Decendent with Beneficiaries 1Notify all creditors2File tax returns and pay final taxes3File the final accounting with the probate court4Distribute remaining assets to beneficiaries5File a closing statement with the court. Create your eSignature and click Ok. 3 distribution can be made after the beneficiaries each execute a Refunding Bond and Release. See Step 348 above and forms below.

Source: pinterest.com

Source: pinterest.com

Trustees have a legal duty to keep the beneficiaries of a trust informed about how the trust assets are being managed. This steps objective is to discuss with the Beneficiaries the estate subject to final changes their likely inheritance value and inheritance distribution. Select the document you want to sign and click Upload. Create your eSignature and click Ok. A typed drawn or uploaded signature.

Source: taxattorneydaily.com

Source: taxattorneydaily.com

Beside above when can I expect an estate tax closing letter. In practice the primary purpose and benefit of receiving the Estate Closing Letter is that it gives the estates executor clearance to wrap up and close the estate including the distribution of any remaining property that may have been held back as a contingency in case anymore Federal estate taxes were assessed against the estate. 3 distribution can be made after the beneficiaries each execute a Refunding Bond and Release. File a closing statement with the court. Form 706 is also used to.

File a closing statement with the court. Form 706 is also used to. File the final accounting with the probate court. See Step 348 above and forms below. As executor I am responsible for the administration of the estate.

Use the example given below to draft formal and informative letters to beneficiaries as an executor of the trust in a brief and crisp manner. This is not always possible particularly in light of the fact that it generally takes a minimum of nine months to get a closing letter from the IRS. Select the document you want to sign and click Upload. It determines the amount of estate tax due pursuant to IRS Code Chapter 11. File the final accounting with the probate court.

Source: ameriestate.com

Source: ameriestate.com

How do you write a beneficiary letter. If the trustee is not required to send a particular document to the beneficiaries based on state law or the trust agreement the item may be omitted. The types of documents that should be enclosed with a Final Trust Distribution Letter will vary depending on the circumstances. Publish Notice of Intended Distribution with the Supreme Court. Save the letter to heirs of estate sample print or email it.

Source: mcampbellcpa.com

Source: mcampbellcpa.com

Accordingly please find enclosed a check made payable. It determines the amount of estate tax due pursuant to IRS Code Chapter 11. See Step 347 above and forms below. File tax returns and pay final taxes. Estate tax closing letters will only be issued upon request by the taxpayer or taxpayers representative.

Source: signnow.com

Source: signnow.com

File a closing statement with the court. Save the letter to heirs of estate sample print or email it. Use the example given below to draft formal and informative letters to beneficiaries as an executor of the trust in a brief and crisp manner. Form 706 is a rather lengthy return that the executor of an estate will file after the death of an individual. Accordingly please find enclosed a check made payable.

Source: signnow.com

Source: signnow.com

Use the example given below to draft formal and informative letters to beneficiaries as an executor of the trust in a brief and crisp manner. Select the document you want to sign and click Upload. Use the example given below to draft formal and informative letters to beneficiaries as an executor of the trust in a brief and crisp manner. File the final accounting with the probate court. If the beneficiaries dont have good current information they cant protect their.

This site is an open community for users to submit their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site convienient, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title estate closing letter to beneficiaries by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.